On March 1st, a significant event occurred in the FPGA industry. The PSG division, which was spun off from Intel, officially announced its "new name": the once-famous brand Altera. Yes, Altera is back as the king.

From the introduction by Sandra Rivera, who was once in charge of Intel's Data Center and Artificial Intelligence (DCAI) division and was appointed as the CEO of the restructured Altera, we learned that Altera is currently pursuing the entire potential market, mainly targeting Xilinx, but also targeting Achronix and Lattice Semiconductor. Achronix, like Xilinx and Altera, sells FPGAs to data centers. All four companies have embedded and edge use cases, covering defense and aerospace, telecommunications and networking, industrial and other industries, as well as outside the data center.

Overall, in addition to the standard use cases of networking, automotive, consumer goods, and industrial products, Altera is also pursuing data analysis, SmartNIC and DPU, 5G and 6G mobile infrastructure, robotics and motion control, video conferencing and distribution, as well as machine vision workloads, testing and medical, and defense electronics. Here is the overall roadmap and customer segmentation of Altera's FPGA series, and their comparison in terms of functionality, cost, and capacity:

Advertisement

From the above introduction, we can see the determination of the new Altera. The FPGA market is also stirring up waves again.

The re-spun of FPGA has sparked extensive discussions in the technology circle. This decision marks the separation of the two major technological paths of CPU and FPGA, and also raises thoughts about the future development path of FPGA: should FPGA develop independently, or is it more appropriate to be closely integrated with the CPU? What changes will this bring to the competitive landscape of the FPGA market? Domestic FPGA manufacturers may face new competition.

The ups and downs of CPU and FPGA

The world's trend is to unite after a long separation and to separate after a long unity. Here, let's also review the ups and downs between Intel and Altera, and between CPU and FPGA.

According to Wikipedia, Altera was established in 1983. As early as 1984, the company established a long-term design partnership with Intel and became a publicly listed company through an initial public offering (IPO) in 1988. Moreover, in 1994, Altera also acquired Intel's PLD business for $50 million.In June 2015, Intel announced the acquisition of FPGA giant Altera for $16.7 billion. This deal shocked the entire tech industry and sparked numerous speculations in the industry about the future development of FPGA.

There were several main reasons for Intel's acquisition of Altera:

- Enhance its competitiveness in the data center field. Altera had leading technology and market share in the FPGA field, and its products were widely used in data centers, communications, networks, and other fields. The acquisition of Altera could help Intel expand its product line in the data center field and enhance its competitiveness with FPGA manufacturer Xilinx.

- Expand new market opportunities. Altera had rich experience and technology in the field of programmable logic devices (PLDs), which could help Intel expand into new market opportunities, such as the Internet of Things, automotive electronics, and other fields.

- Improve R&D strength. Altera had a strong R&D team, and its technical strength was highly regarded in the industry. The acquisition of Altera could help Intel enhance its R&D strength and maintain its leading position in the technology field.

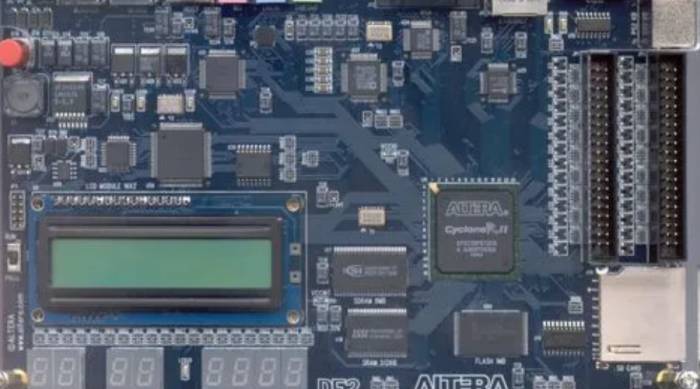

After the acquisition, Altera was integrated into a new business unit of Intel, named "Programmable Solutions Group" (PSG). This business department later developed Intel's Agilex, Stratix, and other FPGA products. In particular, the Agilex FPGA family they created covered the low, mid, and high-end markets. Among them, the high-end FPGA product line Agilex 7 achieved great success.

However, nine years after the acquisition of Altera, Intel publicly announced on October 4, 2023, that it would spin off its Programmable Solutions Group (PSG). From January 1 of this year, PSG has operated as an independent entity and plans to conduct an initial public offering (IPO) for the business within the next two to three years.

So, why did the CPU and FPGA "break up"?

Regarding Intel's spin-off of the FPGA business, domestic professionals believe: "Even looking at it now, Intel's acquisition of Altera in 2015 was a forward-looking strategic move. At that time, Intel was actively deploying its data center business and hoped to strengthen its leading position in the data center acceleration field by acquiring Altera.

However, during the integration process after the acquisition, Intel did not fully leverage the value of Altera's FPGA business. On the one hand, the FPGA business (PSG division) accounted for a low proportion of Intel's total revenue, with an annual revenue of less than $3 billion, accounting for only about 3-4% of its total revenue. Therefore, it did not receive enough attention, leading to the loss of some of Altera's employees. On the other hand, Intel tried to deeply integrate Altera's FPGA chips into the CPU, but this process did not go smoothly.In light of the aforementioned reasons, Intel's acquisition of Altera did not yield the expected significant benefits and weakened the independent development potential of the FPGA business. Therefore, Intel's decision to release the FPGA business to allow for independent development may be more conducive to technological innovation and commercial growth in this field. This is a decision based on business strategy considerations.

Huang Letian, deputy director of the Integrated Circuit and System Research Center at the University of Electronic Science and Technology of China's Yangtze River Delta Research Institute (Huzhou) and an "Altera Gold Lecturer," believes that when Intel acquired Altera, the intention was to combine FPGAs with heterogeneous computing. At that time, they discussed the entire FPGA's computational energy efficiency ratio, which was higher than that of GPUs. If FPGAs could be developed into a GPFPGA like GPUs, or FPGAs characterized by algorithm acceleration or computational acceleration, they could be closely integrated with CPUs to improve overall performance.

Here, we need to understand the fundamental differences between CPUs and FPGAs. A CPU (Central Processing Unit) is a general-purpose processor designed to perform a wide range of computational tasks, with a fixed hardware architecture and instruction set. In contrast, an FPGA (Field-Programmable Gate Array) provides programmable hardware, allowing users to customize logic circuits according to specific applications. This flexibility gives FPGAs an advantage in terms of efficiency and customization when handling specific tasks.

"Intel has invested a lot of resources in developing universal computing frameworks such as OpenCL and OneAPI, trying to incorporate FPGAs into the realm of general programming. However, practice has shown that FPGAs are not suitable for this role, leading to the neglect of traditional communication networks and signal processing markets. In fact, the essence of FPGAs is closer to communication devices, more suitable for tasks such as I/O interface aggregation and data preprocessing," Huang Letian told the author. It was not until recently that Intel introduced the Agilex FPGA family, which once again focused on communication signal processing and network switching as key releases. Especially in the Agilex FPGA, the introduction of the AIB protocol and Chiplet technology based on EMIB integrates I/O interfaces and dedicated accelerators as peripheral Chiplets of FPGAs, allowing for flexible matching of various interfaces for specific application scenarios such as network switching and wireless communication, returning to the "home field" where FPGAs are suitable for customized design in specific scenarios.

"In general, in the AI era, FPGAs have not become a universal computing device that can compete with GPUs. Or the integration of FPGAs and CPUs should not be done in the way Intel did, and they should not be regarded as an accessory to FPGAs or a simple accelerator. Later, Intel also embarked on the path of self-developing GPUs," Huang Letian said.

This decision was made after Intel realized that it had made mistakes in managing PSG. Intel mentioned in its documents that although PSG has set financial records, Intel believes that PSG is insufficiently serving the truly high-growth, high-profit FPGA market (such as industrial, automotive, defense, and aerospace). After becoming a formal part of Intel's DCAI (Data Center and Artificial Intelligence), PSG mainly focused on data center solutions, neglecting other business areas.

From the perspective of market demand and technological development: CPUs, as general-purpose processors, have formed a mature market and application ecosystem. FPGAs, on the other hand, show unique advantages in specific fields (such as data centers, network processing, specific computational acceleration, etc.), but their market is relatively specialized and has higher customization requirements. Intel's decision to split the FPGA business may be to allow FPGAs to achieve more focused and in-depth development in their areas of expertise.

Is it better for FPGAs to be "single" or to be combined with CPUs?

So, the question arises, for FPGAs, is it better to develop independently or to be combined with CPUs. Market demand and technological trends are the key factors that determine the direction of FPGA development. With the rise of artificial intelligence and machine learning, the demand for high-performance, high-efficiency computing is increasing. In this context, the flexibility and customizability of FPGAs make them an attractive choice.

However, both approaches have their pros and cons:1. Independent Development:

Advantages: The flexibility and programmability of FPGAs are their greatest strengths. In specific application scenarios, such as wireless communication, data center accelerators, networking equipment, and signal processing devices, these characteristics of FPGAs can provide customized solutions to adapt to rapidly changing market demands. Independent development allows FPGAs to focus more on innovation in these fields, accelerating technological iteration and market response speed. In addition, independent FPGA suppliers can collaborate with various CPU manufacturers, enhancing market adaptability and flexibility.

Disadvantages: It may require more resources and time to develop products deeply integrated with specific applications, and in terms of generality and ease of use, they may not be well integrated with other programmable resources.

2. Integration with CPU:

Advantages: It can combine the generality of CPUs with the flexibility of FPGAs, providing a solution that is both universal and efficient. For applications that require rapid processing of large amounts of data (such as big data analysis, cloud computing), this integrated solution has obvious advantages. Integrating FPGAs with CPUs on the same chip can achieve high efficiency and low latency in data processing. The integrated design can reduce data transfer latency between chips, improve energy efficiency, and is particularly advantageous in applications with limited space and power consumption (such as mobile devices and embedded systems). At the same time, as computing needs become more diverse, integrated CPU and FPGA solutions also show their unique value.

Disadvantages: The complexity of technical integration may increase, leading to increased development costs and time. In terms of efficiency for specific applications, it may not be as good as fully customized FPGA solutions. At the same time, CPU manufacturers often have a "CPU centrism" mentality, over-emphasizing the integration of FPGAs with CPUs while neglecting the development needs of FPGAs themselves.

Overall, Intel's spin-off of its FPGA business reflects the diversity of technological development and the differentiation of market demands. For FPGAs, whether it is independent development or integration with CPUs, the key lies in how to better serve specific application scenarios and market demands. In the future, we may see more FPGA products optimized for specific fields, and we will also see deep integration of CPUs and FPGAs in some applications. This diversified technological path will better meet the constantly changing market and technological demands.

"FPGA+" is the development trend

"If you want to enter the high-end market, using only a pure FPGA, I think it is becoming increasingly difficult. It's not that you provide a local table of several megabytes, and then a FPGA with hundreds of millions or billions of gates can perfectly solve the problems needed by this large system." A domestic professional said, "CPU+FPGA" or "FPGA+" is a trend in the development of the AI era. Because now many technical business and system-level issues on data centers have been settled. Moreover, with the rapid development of AI such as ChatGPT, the demand for high computing power is increasing significantly. AMD's acquisition of Xilinx is also for the demand of high computing power. AMD is integrating CPUs, GPUs, and FPGAs to create heterogeneous and diverse product lines to meet future demands for computing power and flexibility.

"Therefore, whether it is in the form of Die, Chiplet, or the simpler SiP form, 'FPGA+' is definitely a technological direction. This trend has been reflected in the small application market. However, to achieve a perfect application of 'FPGA+', issues including software level, system level, and the reliability and power consumption of the chip still need to be resolved." He continued to point out.In high computational power application scenarios, the combination of a more powerful CPU and a large FPGA is necessary. During this development process, the technological path of FPGAs may undergo adjustments, shifting from the traditional structure dominated by lookup tables (LUTs) to a higher level of abstraction, such as coarse-grained models, elevating the LUT level to computational units, and adding more computational units, such as DSP slices, to compensate for the CPU's lack of parallel acceleration capabilities.

He then cited Xilinx's latest mass-produced 7-nanometer ACAP FPGA as an example, pointing out that it contains many innovative elements and is no longer limited to traditional lookup tables. These innovations include faster clock speed channels, improved wiring structures, dedicated AI engines and vector computing engines, and DSPs that have been transformed to meet the data processing needs of the AI era. These subtle adjustments reflect the evolution and adaptation of FPGA technology in the AI era.

However, Huang Letian also pointed out that FPGAs have become too complex, and it is uncertain how many people will be willing to pay for them. "Complex devices have a usage threshold," Huang Letian noted, "In fact, Intel's strong promotion of OpenCL and OneAPI is also aimed at reducing the usage threshold, but the actual effect is not very successful." "For ultra-heterogeneous complex devices like ACAP, it is a great challenge for application engineers to truly coordinate and leverage the capabilities of various programming resources, which in turn limits their further promotion and use."

"From a timing perspective, AMD's acquisition of Xilinx (in 2022) is more appropriate than Intel's acquisition of Altera, which was a bit too early in 2015. Although the direction was correct, many markets were not yet mature at the time, and this move did not fully leverage its potential value," domestic professionals also pointed out.

In conclusion: Ripples in the calm FPGA market

After Intel acquired Altera, some customers, out of concern for the change in sellers, turned to purchase products from other FPGA manufacturers, including Xilinx, Lattice, and emerging domestic manufacturers, which released many opportunities. Huang Letian pointed out: "At present, the market share of domestic FPGAs has increased from less than 5% five years ago to the current 20-30%. Although the growth is due to various factors, the objective vacancy in the traditional FPGA field after Altera was acquired in the past five years has created a great development opportunity for domestic FPGAs."

However, after this FPGA business operates independently, it will re-enter the market competition as an independent FPGA manufacturer, which may cause some disturbance to the existing market structure. On the one hand, Altera will seek to regain lost customers, and on the other hand, it will launch more diverse products, even entering the low-end market to capture more market share.

"For domestic FPGA companies, I think it will usher in another competitor. Although it was also a very strong competitor before, it is now more aggressive in terms of Xilinx, but now this PSG department is adopting a more aggressive approach to seize more of the market, and there may be more diverse forms of products, and it may even re-enter the low-end market."

Huang Letian believes that the re-independence of Altera is a "comeback of the king" for the FPGA market. Currently, the Agilex FPGA has performed well in the Chiplet technology route centered on FPGAs, and Altera is expected to lead the innovation of the traditional FPGA market again.For domestic FPGA manufacturers, this undoubtedly brings greater challenges, but also implies opportunities. Domestic FPGA manufacturers need to further enhance product competitiveness and market strategies in order to establish themselves and grow in fierce competition.

Post a comment