Over the past two decades, RF GaN technology has been continuously evolving. Initially rooted in defense applications, it is now exploring new areas to meet the needs of telecommunications infrastructure and satellite communication. With the increasing maturity of gallium nitride on silicon carbide (GaN-on-SiC) technology, GaN is becoming the standard for various applications, steadily gaining market share against competing technologies such as Si LDMOS and GaAs. With a focus on power efficiency, reliability, and space optimization, GaN technology has become indispensable.

The telecommunications infrastructure market is witnessing a significant shift in the requirements for power amplifiers (PA), paving the way for Infineon's launch of GaN-on-Si technology on an 8-inch platform in 2023. This strategic move not only intensifies competition with GaN-on-SiC but also opens up new prospects, especially in the mobile phone market.

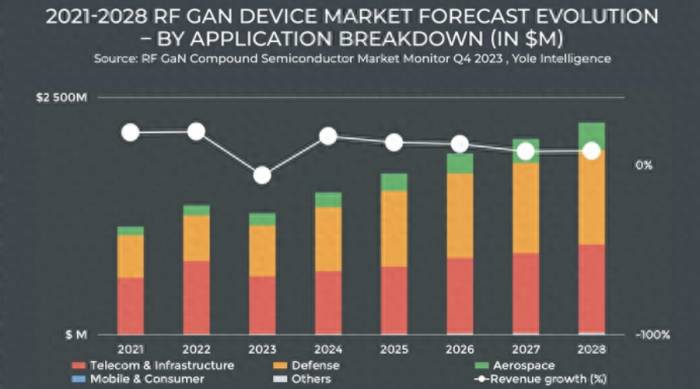

According to Yole Group's RF GaN compound semiconductor monitoring report, driven by demand from 5G telecommunications infrastructure and defense radar applications, the overall value of the GaN RF device market is expected to soar from $1.4 billion to over $2.2 billion, with a compound annual growth rate (CAGR) of 8.7% during the period from 2022 to 2028.

Advertisement

Although the development speed of the RF GaN market during the period from 2022 to 2028 may not be exactly the same as that of the wide-bandgap (SiC and GaN) market for power conversion applications, it is still vibrant and changing its supply chain. The main players in the industry, such as the US-based MACOM, completed two major acquisitions in 2023: the GaN-on-Si technology of French company OMMIC SAS and the RF GaN-on-SiC business of US-based Wolfspeed (a leader in the RF GaN field). These strategic moves position MACOM as one of the potential leaders in the RF GaN field. Meanwhile, manufacturers such as SEDI, Qorvo, and NXP maintain a strong leadership position in the RF GaN industry.

In China, companies such as SICC, San'an Integrated Circuit, Dynax, and CETC continue to develop and explore the local RF GaN market. At the beginning of 2023, Infineon introduced the first commercial GaN-on-Si PA technology for the telecommunications infrastructure market using 8-inch wafers. Other manufacturers such as STMicroelectronics, UMC, and GlobalFoundries may follow suit in the coming years.

RF GaN has achieved success in various applications. Since the 1990s, the US Department of Defense has recognized the superior output power and efficiency of RF GaN-on-SiC compared to materials such as InP, GaAs HBT, GaAs HEMT, and Si LDMOS. RF GaN not only provides a wider bandwidth but also helps to reduce system size - both of these attributes are highly sought after as telecommunications infrastructure expands its frequency and base station models.

The excellent power and efficiency characteristics of RF GaN have led to its widespread adoption in defense applications, especially in addressing thermal challenges in high-power scenarios such as airborne radar systems. As one of the largest sectors in the RF GaN market, defense continues to stand out. Airborne systems are characterized by a large number of devices and are expected to dominate the market, with the number of devices in shipborne systems also expected to increase in the coming years.Outside the United States, Europe and China are actively cultivating their GaN ecosystems, with a particular focus on expanding their deployment in radar applications. Ongoing demonstrations and GaN projects in this field guarantee sustained growth. Due to its wideband operation and enhanced reliability, GaN is more favored by the industry than alternative technologies. Satellite communications are expected to experience significant growth between 2022 and 2028. GaN devices will become the preferred choice for deploying Ka-band block upconverter systems, showcasing a combination of high power output and lightweight characteristics. In the C and X band areas, the selection of GaN systems is guided by the key criterion of power added efficiency (PAE).

At the same time, RF GaN has begun to enter the credit satellite communication market, using its high efficiency relative to other materials to achieve smaller device sizes, thereby saving valuable space at the system level. Satellite communication is the third largest RF GaN market after telecommunications infrastructure and defense markets, and is expected to reach $270 million by 2028, with a compound annual growth rate of 18% from 2022 to 2028.

RF GaN power amplifiers provide higher data throughput, smaller antennas, wider bandwidth, and higher efficiency. Transitioning from L/C/X bands to Ku/Ka bands can achieve higher data rates for mobile satellite communication. Although traveling wave tube (TWT) technology has historically dominated, it also has limitations, such as bulkiness and reliability issues. GaAs-based solid-state power amplifiers (SSPAs) are attracting interest in low-power and lightweight satellite systems, but their efficiency and bandwidth are limited compared to GaN.

Compared with GaAs SSPAs, GaN PAs also have many advantages, making them attractive for various applications such as GEO HTS, "New Space," LEO, and higher frequency Earth observation. We are witnessing an increasing focus on satellite communication, especially due to the growing interest in the "New Space" trend.

In addition, the telecommunications infrastructure industry is increasingly focusing on satellite communication, especially SpaceX's plan to provide 5G coverage through satellite technology. This approach enhances the possibility of covering areas of the world that lack reliable telephone network coverage. RF GaN technology can seize this opportunity to expand its market share.

GaN-on-SiC for telecommunications infrastructure was initially launched by Huawei in 2015 and began mass production in 2020 for 4G base stations. Since then, RF GaN technology has benefited from the launch of 5G by meeting new base station requirements and replacing LDMOS technology. Companies around the world, such as SEDI, Wolfspeed (whose RF business is now part of MACOM), NXP, and Qorvo, have also made significant investments to ensure that GaN-on-SiC dominates its target applications and replaces its corresponding Si LDMOS.

4G micro base stations and macro base stations are mainly based on RRH (remote radio heads), integrating the base station's RF chain and analog-to-digital conversion components with up to 8 multi-stream PAs, with an output power of up to 100W.

As the 4G era is coming to an end, the reliance on LDMOS-based PAs for 3GHz base stations is expected to decrease. Emerging 5G base stations below 6GHz are shifting from 2x2 MIMO models to 64x64 massive MIMO (mMIMO) and replacing RRH with active antenna systems (AAS).

While increasing the number of PAs, each PA is expected to operate at a lower output power (from 100W to 5W). PAs also need to handle the increasing data traffic while reducing power consumption.

GaN can meet all these requirements. As GaN-on-SiC addresses the issue of 5G frequencies up to 7GHz, the market share of LDMOS is expected to decline. For 5G millimeter wave and 6G, due to the higher requirements for high frequency and lower power consumption, RF GaN technology is expected to face more intense competition with other materials such as SiGe and InP.How is RF GaN developing?

Due to the need for low-power PAs in sub-6GHz 5G telecommunications base stations, GaN-on-Si will have a place in 32T32R / 64T64R mMIMO base stations operating below 10W. Over the past two years, STMicroelectronics has collaborated with major players such as MACOM, OMMIC (now part of MACOM), GCS, Infineon Technologies, and foundries such as Global Foundries and UMC to launch RF silicon-based gallium nitride (GaN-on-Si) technology.

The shift to millimeter wave small cells (2-stream and 4-stream) operating at 28-60GHz with reduced output power brings additional opportunities for GaN-on-Si. As telecommunications infrastructure increasingly adopts systems with lower output power, the demand for antenna array systems (AAS) and small cells has driven the adoption of silicon-based gallium nitride to meet the performance requirements of multi-stream, small cells, and millimeter wave beamformers.

Looking forward to the next generation of 6G, which will have higher frequencies, it is expected that GaN-on-Si will coexist with the existing technology GaN-on-SiC.

A significant development this year is the launch of GaN-on-Si PAs using 8-inch technology by Infineon Technologies to meet the needs of the telecommunications infrastructure market. Anticipating this trend, other major manufacturers such as Global Foundries, UMC, MACOM, and STMicroElectronics are expected to follow suit in the coming years. It is worth noting that many manufacturers choose to enter the market directly using GaN-on-Si, bypassing GaN-on-SiC technology.

By 2028, GaN is expected to account for more than 87% of the shipments of telecommunications infrastructure PA devices. Of these, over 77% will be gallium nitride on silicon carbide (GaN-on-SiC), 10% will be gallium nitride on silicon (GaN-on-Silicon), and LDMOS is expected to lose market share.

The prospects for silicon-based gallium nitride technology extend to power amplifiers for 5G mobile phones in the FR3 frequency band. Although silicon-based gallium nitride has potential in mobile phone PAs below 7GHz and 5G millimeter wave frequencies, it must be acknowledged that mature GaAs solutions have a dominant position below 7GHz and the appeal that silicon-based solutions have gained in millimeter waves. These technologies have matured in terms of technology and supply chain, becoming significant competitors. In the open competition for FR3, silicon-based gallium nitride is promising, but complex design changes are required to integrate into mobile phone systems, making its adoption in the FR3 frequency band a long-term goal.

The decisive influence on the fate of silicon-based gallium nitride technology ultimately depends on smartphone original equipment manufacturers (OEMs) such as Apple, Samsung, and Xiaomi, which could become a turning point for the silicon-based gallium nitride industry.In the mobile ecosystem,

RF GaN Continues to Draw Attention

Today, gallium nitride on silicon carbide (GaN-on-SiC) serves as the primary platform, with a well-established supply chain. Device suppliers such as SEDI, Qorvo, Wolfspeed, and NXP, as well as defense-related companies like Raytheon, BAE Systems, and Northrop Grumman, all offer GaN-on-SiC technology.

In 2022, SEDI, Qorvo, and Wolfspeed were the leading manufacturers in the RF GaN sector. As a newcomer in the GaN field, NXP entered the telecommunications supply chain in 2020 by opening a 6-inch GaN-on-SiC wafer factory in the United States, achieving significant growth. Their LDMOS products have become a leading enterprise in the GaN-based telecommunications infrastructure field. Additionally, gallium nitride on silicon carbide has welcomed innovative manufacturers such as Altum RF, mmTron, and GaN Semiconductors in the past few years. Now, this expanding industry offers more room for GaN-on-Si technology, where low-power GaN solutions are expected to be used in 32T32R / 64T64R mMIMO base stations with less than 10W, with more products hitting the market this year.

The S.I.SiC wafer market is still dominated by the three major suppliers Wolfspeed, Coherent, and SICC. In the defense sector, companies like Raytheon and Northrop Grumman are at the forefront of GaN adoption. Wolfspeed and Qorvo are also GaN foundries. Surrounding the supply for the telecommunications market, Ericsson and Nokia continue to expand the supply of RF GaN devices from multiple device suppliers, while Samsung collaborates closely with South Korean device manufacturers. Since the U.S. sanctions, Huawei and ZTE have turned to the Chinese supply chain to develop their own capabilities.

To overcome U.S. sanctions, China continues to develop its domestic RF GaN technology and Chinese supply chain. In the GaN-on-SiC ecosystem, leading manufacturers are world-class at both the wafer and end-system levels, and since 2020, China has been accelerating the development of epitaxial wafers, front-end, back-end processes, and design. There is more than one active participant at each level, demonstrating the progress of the Chinese ecosystem in the past two years.

Yole Intelligence's RF GaN 2023 report accurately predicted Wolfspeed's decision to spin off its RF business, marking a strategic shift towards SiC power technology. Following the initial acquisition in 2018 for $345 million, Wolfspeed was acquired by Infineon Technologies for $125 million, making Wolfspeed a major player in the power SiC industry. The decision to stop supplying competitors after the sale has enhanced their expansion potential.

In the meantime, MACOM's early exploration of silicon-based gallium nitride since 2018 and its collaboration with STMicroelectronics have made it a pioneer. The successful production of RF GaN-on-Si prototypes in 2022 reflects their commitment to introducing GaN-on-Si technology, emphasizing its application in telecommunications and consumer fields. MACOM's strategic acquisition of OMMIC SAS in 2023 demonstrates their focus on millimeter wave technology, enhancing their product portfolio in the U.S. and European defense and aerospace sectors.

In the early 2020s, MACOM strategically shifted its focus to GaN on SiC technology, specializing in the production of high-power devices up to 7kW. Their collaboration with the Air Force Research Laboratory and cooperation with the U.S. defense department have made significant progress in GaN-on-SiC technology, which operates at high frequencies in the K to Ka bands.MACOM recently acquired Wolfspeed's RF business, solidifying its position in the defense, aerospace, and telecommunications markets. With Wolfspeed's standing in the RF GaN market, MACOM has fortified its strategic position, emphasizing its commitment to expanding its share in the RF GaN market through a comprehensive product portfolio that covers a wide frequency range with GaN-on-Si and GaN-on-SiC technologies.

In the silicon-based gallium nitride ecosystem of the past few years, companies such as STMicroelectronics, MACOM, Infineon Technologies, and foundries like GlobalFoundries and UMC have been actively involved in the development and introduction of RF silicon-based gallium nitride technology. Infineon Technologies launched GaN-on-Si PA technology on 8-inch wafers earlier this year to meet the demands of the telecommunications infrastructure market. We hope other players will follow suit.

Companies like GlobalFoundries, STMicroelectronics, and Infineon have been active in the power GaN industry. Despite facing challenges such as technology nodes and epitaxy control, these participants are exploring synergies between RF and power GaN, leveraging similar GaN-on-Si technologies to meet different market demands.

Additionally, innovative companies are entering this ecosystem, such as Finwave, which focuses on developing 3DGaN FinFET technology on 8-inch GaN-on-Si wafers. They use standard silicon manufacturing tools in their development process. Besides these innovative companies, established players like GCS, UMC, Sony, and GlobalFoundries also have the potential to adapt quickly and enter the market.

Participants are gearing up for these killer applications to run their technologies and usher in a new era of high-volume silicon-based gallium nitride manufacturing in the RF industry.

What's next for the RF GaN industry?

In summary, the RF GaN industry has undergone a transformation over the past two decades, shifting from a dominant position in defense applications to coexisting in multiple markets such as telecommunications and satellite communications. Silicon carbide-based gallium nitride technology has become the mainstream technology for power amplifiers in defense and telecommunications infrastructure, capturing market share. The introduction of silicon-based gallium nitride in telecommunications infrastructure heralds growth and brings new opportunities. Yole Group's RF GaN Compound Semiconductor Monitor forecasts robust growth in this market, driven by 5G and defense applications, and expects the RF GaN device market to exceed $2.2 billion by 2028.

The year 2023 is significant to date, as MACOM made two eye-catching strategic acquisitions that could help them gain more market share in the current landscape, while Infineon launched the first GaN-on-Si PA technology based on the 8-inch platform.Globally, Gallium Nitride (GaN) is becoming increasingly important in the defense sector, especially in airborne systems. The emergence of 5G has provided opportunities for GaN in Massive MIMO (mMIMO) base stations, extending into the anticipated era of 6G. Silicon-based Gallium Nitride (SiGaN) shows promise in mobile technology trends but faces fierce competition from established platforms. The RF GaN supply chain is diversifying with the entry of new players, promoting sustainable growth in the future market.

Ultimately, as Silicon-based Gallium Nitride technology matures, the RF GaN industry is at a critical juncture. This raises the question: is it a good time to explore new growth prospects in uncharted markets? Or, can Silicon-based Gallium Nitride gain a larger market share than Silicon Carbide-based Gallium Nitride (SiC-GaN)?

Post a comment